Contents:

It is likely that most investors will be satisfied by returns that roughly mirror the average returns seen from the overall market. Any number that can meet or exceed this goal will constitute a good annual return from one’s mutual fund. Any investor that seeks higher returns would be disappointed by the level of investment in mutual funds, particularly if they do not wish to remain invested for a long time. As compared to absolute returns, CAGR offers investors a more comprehensive picture of how ‘good’ investing in a certain mutual fund scheme can be. It enables one to average down how volatile one’s returns over a certain investment horizon can be.

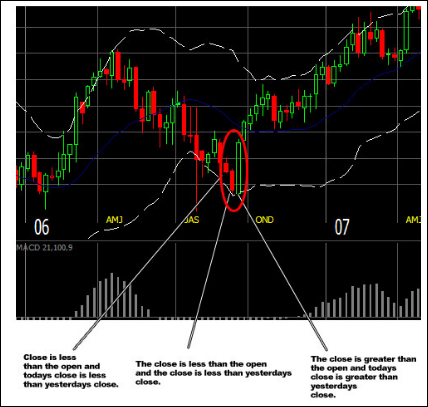

While what is annualized returns determines the volatility of a fund according to the disparity of its returns over a period of time, beta, determines the volatility, or risk, of a fund in comparison to that of its index or benchmark. Rolling returns, also known as “rolling period returns” or “rolling time periods,” are annualized average returns for a period, ending with the listed year. Annualized return indicates what investment would return over a time period if the annual return is compounded.

Motor Insurance

So what indexes should you use to make appropriate comparisons? If you’re examining a small-company fund, use the BSE 250 Small cap benchmark, which is dedicated to small-capitalization stocks. That’s why you wouldn’t want to compare a fund that focuses mostly on small companies, such as Axis Small cap fund, against the Nifty50 index alone. Small-company stocks make up a very small portion of the index, so it would be surprising if the fund performed much like the index at all.

CAGR or Compound Annual Growth Rate gives you the investments annual growth rate over some period of time. You may consider CAGR as a percentage-based metric, which helps you determine the annual rate at which your investment grows over a period of more than one year. You may use CAGR to determine the exact percentage of the returns from your investments each year, across the investment tenure. While an absolute return is simple to quantify, it is difficult to equate to other investments in different terminology. Comparing mutual funds that have exchanged over varying periods of time helps to provide a better view.

Frequent review and tracking of https://1investing.in/ fund returns may tempt you into taking unwarranted impulsive decisions. Do not let an fall in NAVs tempt you to discontinue SIPs or redeeming units from a fund. When there are market falls steeply, try to invest lump-sum amount.

Remains unchanged with the percentage changes in the investment horizon. The table below shows the key benefits of different mutual fund returns in India. Compound Annual Growth Rate – Compound Annual Growth Rate, abbreviated as CAGR, is the rate of return by which the investment should grow from the initial investment value to its maturity value.

What Are the Key Benefits of Each Type of Mutual Fund Return?

Systematic risk is integral to investing in the market and cannot be avoided. Non-systematic risk is unique to a company – can be mimimised by diversification across companies. Since non-systematic risk can be diversified, investors need to be compensated for systematic risk which is measured by Beta. With regards to mutual funds, you can compare the Annualised Returns of that fund with the benchmark returns to get some idea about the performance of that fund, to know if it has performed better than the market or not.

Similarly, you can calculate CAGRs for various investment products and then take your decision which ones are safe investments with high returns in India for you to take into consideration. LenDenClub, a P2P lending platform, helps you achieve such high annualized returns and is something worth checking out here. Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days.

More UTI Mutual Fund

Your right to use the facilities is personal to you; therefore, you agree not to resell or make any commercial use of the facilities. In addition, the Website welcomes your feedback as a user of the facilities. Information published on the Website may contain references or cross references to products, programs and facilities offered by ABC Companies/third parties that are not announced or available in your country.

- Usually when the calculation is for a period of less than one year then absolute returns are used.

- Mutual fund returns are those returns that depend on the performance of the fund.

- Choose the right tool so that you can get the right investment returns which can help you make decisions to hold or sell that particular investment.

- Most investors rely on absolute returns to analyse the performance of their investments.

Nonetheless, the trailing return also has certain limitations. On the face of it, you see that the fund has beaten its benchmark in 5 out of 7 years,i.e., 2015, 2016, 2019, 2020 and 2021. So your first impression is that the fund should have outperformed its benchmark. But when you calculate the return, the fund is actually underperforming its benchmark.

Difference between Absolute and Annualised Returns

However, CAGR is popularly used to gauge return from mutual funds and stocks and not so much for banking. It is the interest you receive in a year over the total investment you make. A single stock or a mutual fund do not provide you with a constant rate of return every year. If you reinvest, then you need to know the profit earned on all the investments together.

All mutual fund performance for periods exceeding one year are expressed in CAGR. AMCs usually disclose 1 year, 3 year, 5 year and since inception CAGRs of their schemes in monthly fund factsheets. Please note CAGR mutual fund is used only for point to point returns; you cannot use CAGR for SIPs, STPs, SWPs, etc.

One of the essential characteristics of a mutual fund scheme’s success is consistency. The rolling return calculator displays rolling returns, which is a genuine indicator of performance consistency. Different investors can have different interpretations of how they want to calculate the returns from their investments.

ROI can be calculated by subtracting the initial investment value from the final investment value . The result is then divided by the cost of the investment and multiplied by 100. Be it traditional investments like fixed deposits or any other banking products, gold and other commodities, equities and bonds and any other market-linked products. ROI can be used to get an idea of returns before investing anywhere, while one is in the middle of the tenure or after redemption, ROI can be used for equity and debt oriented instruments. This brings us to the question, how exactly can you measure a fund manager’s contribution to performance? It is the difference between the return you would expect from a fund, given its beta and the return it actually produced.

What is annualized return with example?

An annualized total return is the geometric average amount of money earned by an investment each year over a given time period. The annualized return formula is calculated as a geometric average to show what an investor would earn over a period of time if the annual return was compounded.

Aditya Birla Capital Group is not liable for any decision arising out of the use of this information. “KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.” Suppose an investor makes a one time investment of Rs. 50 Lakh in a piece of land. Suppose an investor makes a one time investment of Rs. 10 Lakh in Fixed Deposit. This investment becomes 12 Lakhs over a period of three years.

We do not sell or rent your contact information to third parties. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Investors may please refer to the Exchange’s Frequently Asked Questions issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

What is mean annualized returns?

The annualized return is the geometric average of annual returns of each year over the investment period. The annualized return is useful when you want to see the performance of an investment over time or to compare two investments with different time periods.

The lending transaction is purely between lenders and borrowers at their own discretion, and LenDenClub does not assure loan fulfilment and/or investment returns. Also, the information provided on the platform is verified or checked on the best efforts basis without guaranteeing any accuracy of the data/information verification. Any investment decision taken by a lender on the basis of this information is at the discretion of the lender, and LenDenClub does not guarantee that the loan amount will be recovered from the borrower, fully or partially. LenDenClub will not be responsible for the full or partial loss of the principal and/or interest of lenders’ investment amounts.

3 Warren Buffett Stocks Down 6% to 40% That I Would Buy in a … – Nasdaq

3 Warren Buffett Stocks Down 6% to 40% That I Would Buy in a ….

Posted: Mon, 27 Mar 2023 12:15:00 GMT [source]

As a result, such names tend to influence the index’s performance. When you read a fund’s shareholder report, you will always see the fund compared with an index, sometimes more than one. An index is a preselected, widely recognized group of securities, either stocks or bonds.

How do you calculate annualized return?

Example of calculating annualized return

To calculate the total return rate (which is needed to calculate the annualized return), the investor will perform the following formula: (ending value – beginning value) / beginning value, or (5000 – 2000) / 2000 = 1.5.