H&R Block Expat Tax has always been fast, efficient and answers my questions. For 10 years I filed everything myself and never received a refund. First, review the IRS instructions https://kelleysbookkeeping.com/the-role-of-standard-costs-in-management/ for Form 8832 and gather the information you’ll need to complete it. However, in most cases, you can only change your classification once every five years, so you may have to wait.

Single and multi-member LLCs can elect to file taxes as a C-corp using Form 8832. Doing so does expose owners to double-taxation, as C-corps are not pass-through entities. And backed by CPAs to provide you with an accurate tax review.

Step 8. Effective Date of Election (Part I, Question

There are some benefits to altering your status, such as reducing your tax burden. But because Form 8832 isn’t mandatory, it doesn’t have a deadline, per se. You can file it at any point in the lifetime of an eligible business. Whether you’re operating a brand new company or one that’s been around for decades, you can still elect to change its entity classification.

Tax form 1120 is used for C Corporations to report profits, losses, gains, deductions and credits. Form 1120-S is the tax form needed for S corporations. There are certain tax requirements to fulfill for S Corps. When you are an owner of a Sole Proprietorship, you have to file all your taxes and keep up with forms like the Schedule C of 1040, Form 940, 941 and 944.

Step 3. Previous Elections (Part I, Questions 2a and 2b)

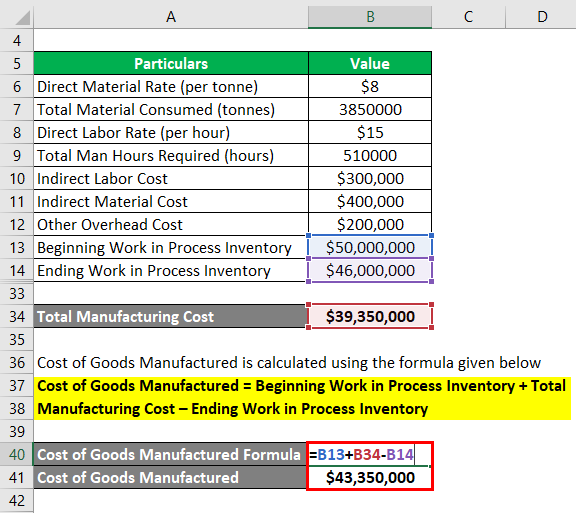

In addition, attach a copy of Form 8832 to the entity’s federal tax or information return for the tax year of the election. Form 8832 must be filed between one year prior and 75 days after its effective date. Most LLCs want their Form 8832 to be effective for their first tax year, so the form must be filed no sooner than one year and no later than 75 days after beginning business. For example, if you started operations on February 1, 2022, Form 8832 must be filed between February 1, 2021, and April 16, 2022. In Question 8, you choose when you want your tax election to take effect.

You are treated as liquidating your current business and transferring all the assets to a newly formed business. This typically has tax consequences, and you should seek the advice of a tax professional before making the change. Choosing how to be taxed has long-term consequences and is one of the most important decisions an LLC will ever make. Form 8832 can be filed again if an LLC wants to change how they’re taxed.

When to file Form 8832 – classification options for foreign entities

Unfortunately, filing form 8832 online is not an option. Use the list below, which is provided by the IRS, to determine where you need to mail your completed form based on the state where you do business. Line 8 – Indicate the date you wish the election to become effective. Remember, the date can generally be no sooner than 75 days before you file Form 8832 and no later than 12 months after you file Form 8832. If the date field is left blank, the IRS will use the form submission date as the effective date. At the top of the form, you’ll enter top level information about the business, such as the entity making an election, its Employer Identification Number (EIN) and its address.

Form 8832 consists of two sections, and the form shouldn’t take a tremendous amount of time to complete. Once eligibility has been determined, ensure that How To File Irs Form 8832 selecting a new entity type makes sense for your business. Let’s explore some benefits of each kind of entity that can be selected using Form 8832.